ASSET BACKED ETI

Investment capital for sale and operation of ecological Miningfarms and photovoltaic plants. With fixed feed-in remuneration and secured by fair value.

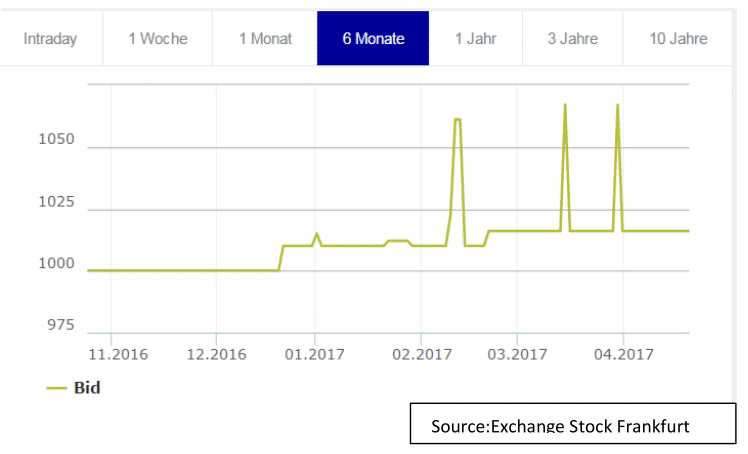

Current exchange rate:

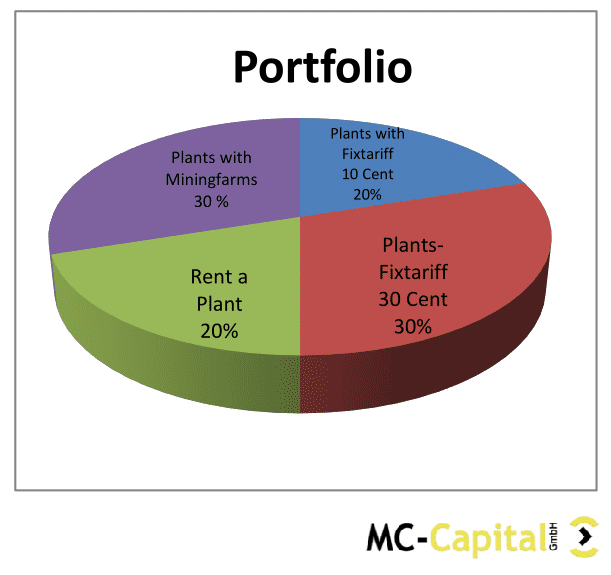

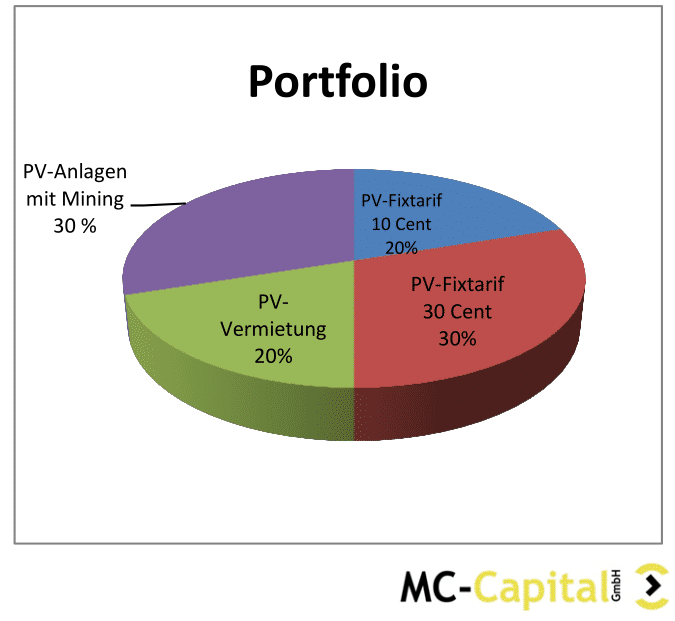

Investment strategy:

Since 2011 the associated company MC-Capital GmbH has

realized until now with private small investors and loans

nearly 3,5 MW photovoltaic plants.

On the basis of past high supports (fixed feed-in remuneration

up to 30Cent/kWp with run times from 13 to 20 years) many plants

were built, where nowadays a secondary market has arisen.

With an ROI from partially 6-8 years! Also there is a rising demand

on the lease of PV plants (in combination with air heating pumps, etc.)

to private homes or companies.

What is also new is the very attractive “mining” of Bitcoins and other crypto

currencies with solar power stations. Here a test mining farm (with currently 35

Bitcoin miners) and a subsidized 50 KWp PV plant by MC Capital GMBH was

successfully put into operation.

*The establishment of additional eco mining farms in Slovenia and Greece is in

the planning phase. In these countries we have the advantage of high solar

radiation and a 100 percent utilization of the solar energy. Moreover special

contracts and subsidies will also be available for these projects. (NETMETERING)

The ROI of the hardware (miner) is currently at six to nine months

* Mining of Bitcoins is the calculation of transactions for which the miner receives a bonus in the

form of Bitcoins

Trading venue: Frankfurt stock exchange

Master data ASSET BACKED ETI

| Type of product: | Index/ participation Certificate |

| Basic investment: | Financial capital for ECO-Miningfarms and PV power plants |

| UCITS-target investment: | Yes |

| WKN/ISIN: | A2CH3Y / MT0001151258 |

| Inception date: | 19.8. 2016 |

| Issue price: | 1000 EUR |

| Available at: | Clearstream |

| Minimum size: | 1 piece |

| Duration: | open end |

| Dividents: | distribution |

| Collateralisation: | Separate individual sub-funds |

| Special rights: | Insolvency protection according to Securitisation Law |

| Emittent: | iStructure PCC plc |

| Clearingplace: | Clearstream |

| Listed: | Frankfurt stock exchange SEDOL |

| Target yield: | 4 % dividends per year 10 % p.a. increase of value |

- Investments independent from stock exchange

- Fixed feed-in remuneration

- Plants as real value

- Long lasting and useful investment

- Support of the Austrian economy

- Professional team

- Retention of title

- Earmarked use by the issuer

investor, as well as in particular by the EU savings tax of the domicile of the paying agent. Investors are advised to seek the advice of a tax consultant before share subscription. Shares may only be purchased or sold in jurisdictions in which their trade is permitted. ECOCAPITAL ETI may not be offered or sold in the United States or to US citizens or persons residing in the United States The securities are issued under an issuance programme of iStructure PCC plc approved by the FSC on 02-nd of August 2016 and complemented by the Final Terms issued on 19-th August 2016 as well as passported for public offering in Austria and Germany. The base prospectus of the issuance program and base prospectus is available at https://www.gsx.gi/document/sp/6 .

INITIATOR

MC-Capital GmbH und CEO Peter Aldrian

Johann-Seifried-Ring 1

A-8054 Seiersberg/Austria

E-Mail: office@mc-capital.eu

Web: www.mc-capital.eu

Telefon: +43 316 931219 – 460

Link zum Termsheet Prospekt: https://www.gsx.gi/document/sp/6